[最新] bond yield to maturity calculator semi annual 333934-How to calculate yield to maturity semi annual

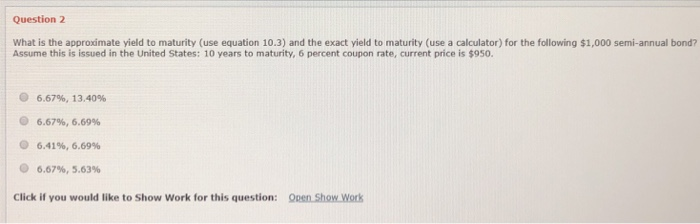

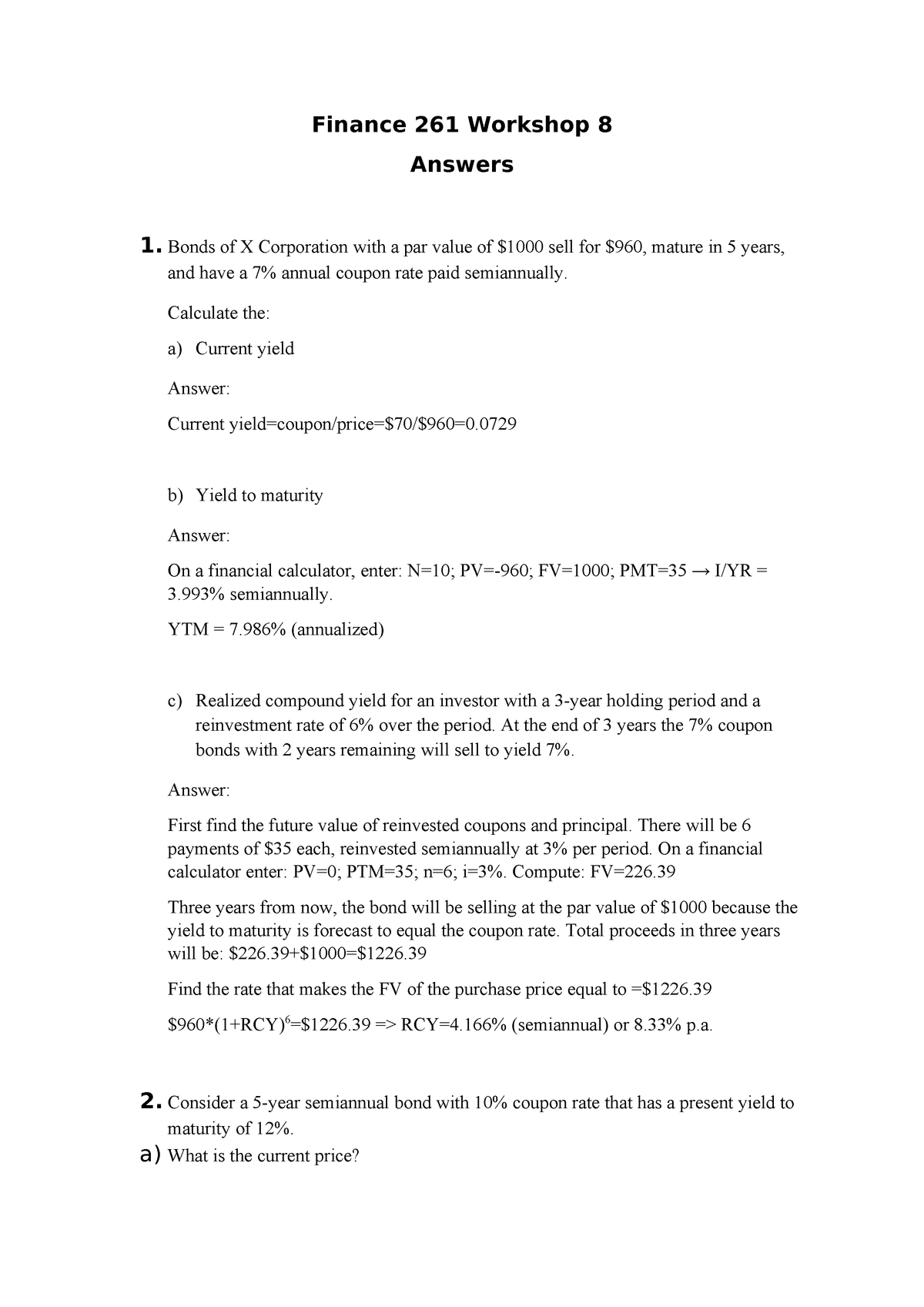

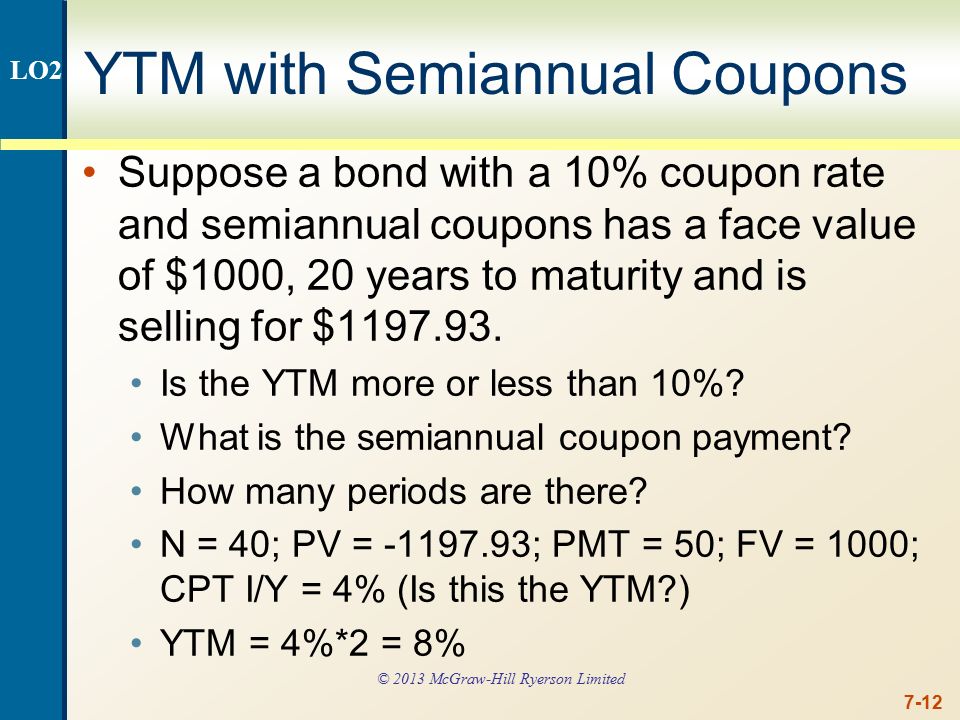

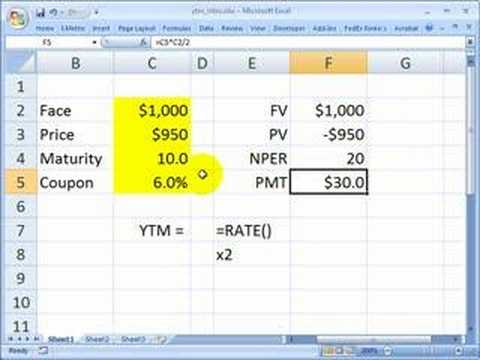

This yield to maturity calculator uses information from a bond and calculates the YTM each year until the bond matures It uses the par value, market value, and coupon rate to calculate yield to maturityOn this page is a bond yield to maturity calculator, to automatically calculate the internal rate of return (IRR) earned on a certain bond This calculator automatically assumes an investor holds to maturity, reinvests coupons, and all payments and coupons will be paid on time The page also includes the approximate yield to maturity formula, and includes a discussion on how to find – or approach – the exact yield to maturityCalculate the yield to maturity for this bond using the time value of money keys on a financial calculator and solving for the interest rate (I) of 3507% In this case, the interest rate is the semiannual rate and can be multiplied by two for an annual rate of 701%

Yield To Maturity Formula Step By Step Calculation With Examples

How to calculate yield to maturity semi annual

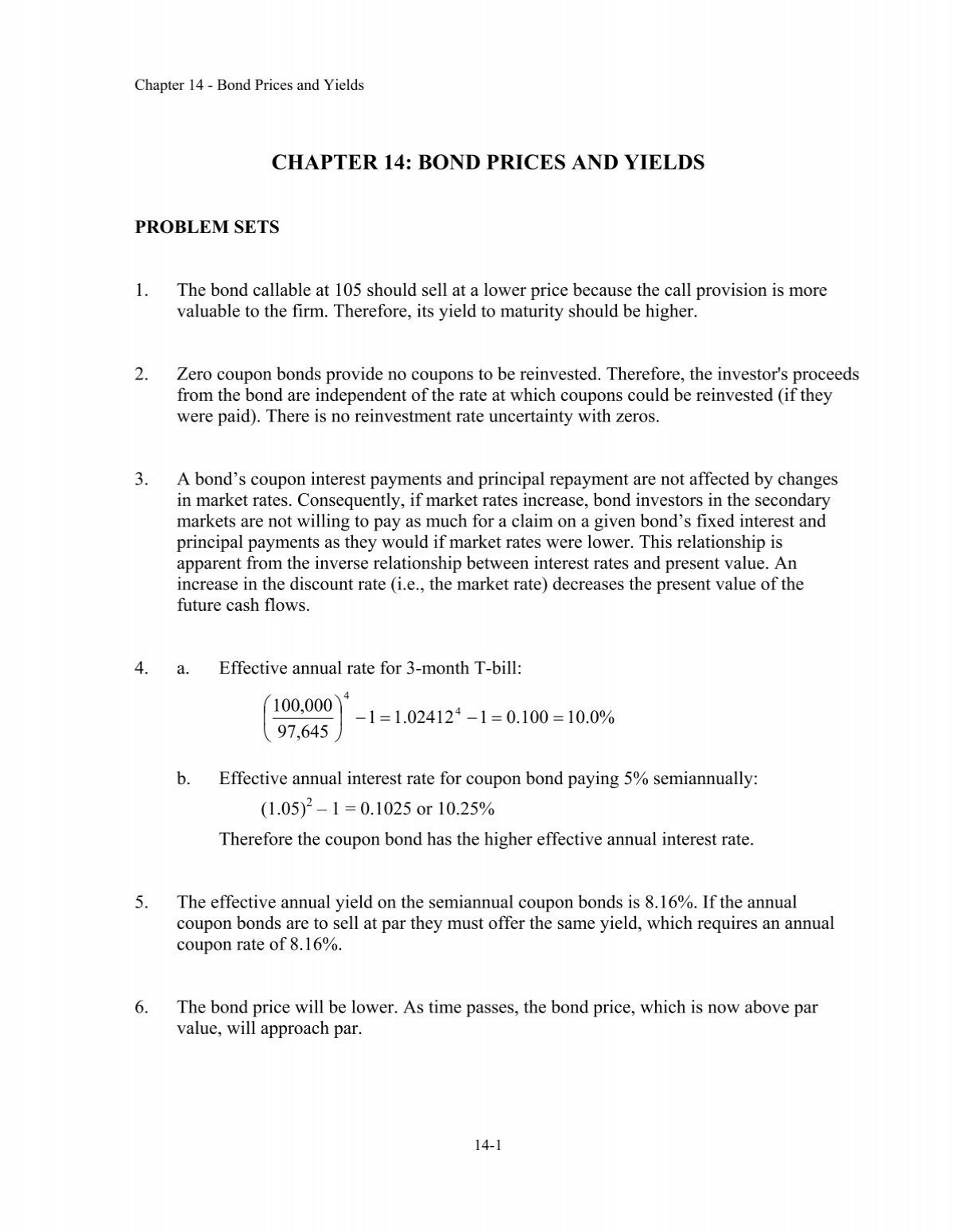

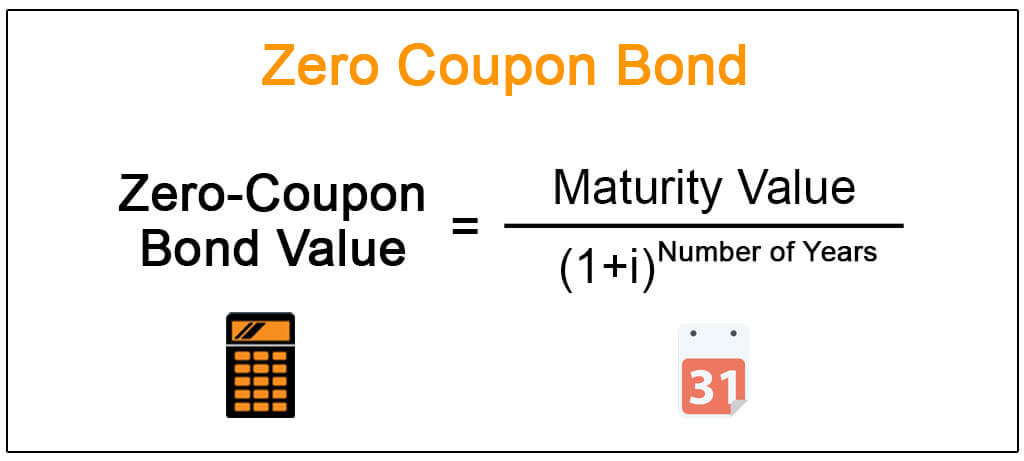

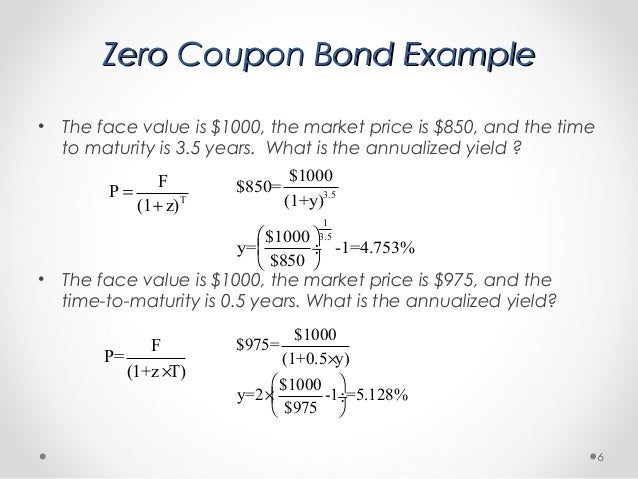

How to calculate yield to maturity semi annual-Zero Coupon Bond Effective Yield Formula vs BEY Formula The zero coupon bond effective yield formula shown up top takes into consideration the effect of compounding For example, suppose that a discount bond has five years until maturity If the number of years is used for n, then the annual yield is calculated Considering that multipleN = number of semiannual periods left to maturity;

21 Cfa Level I Exam Cfa Study Preparation

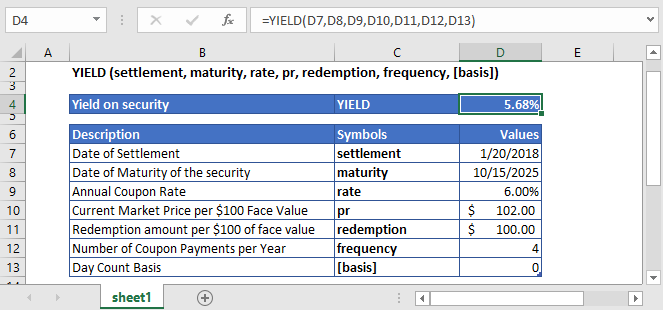

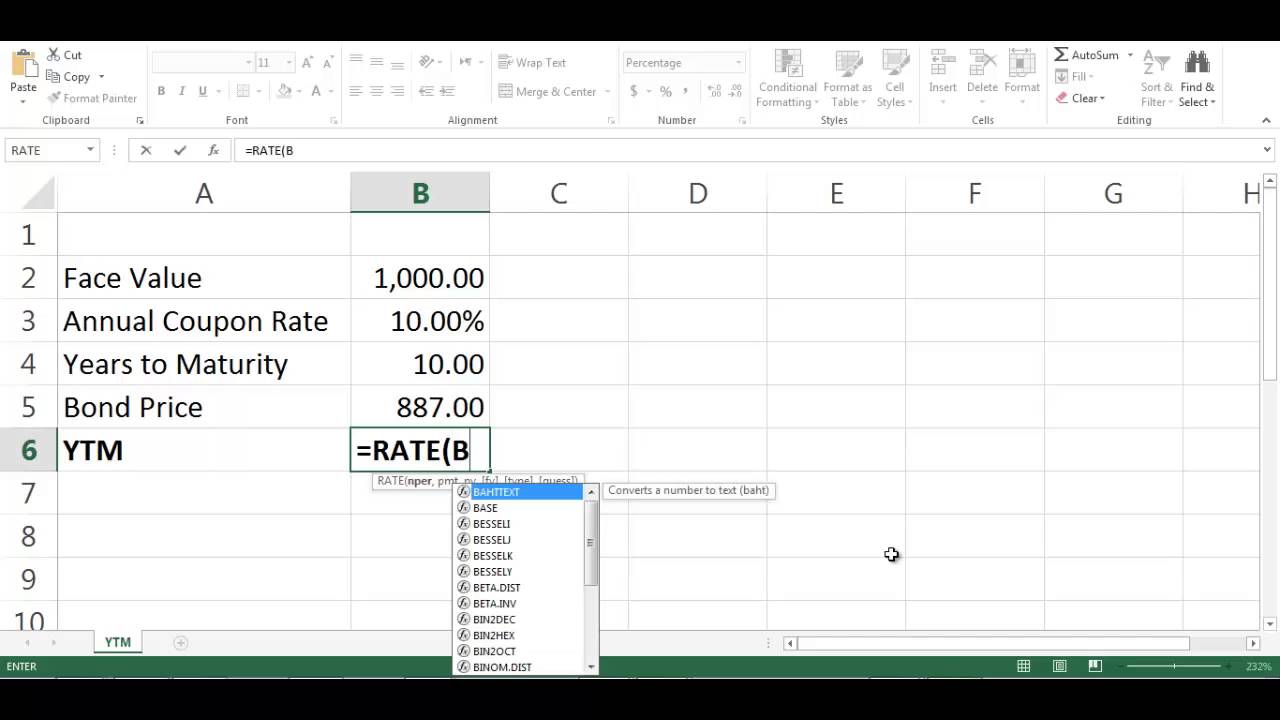

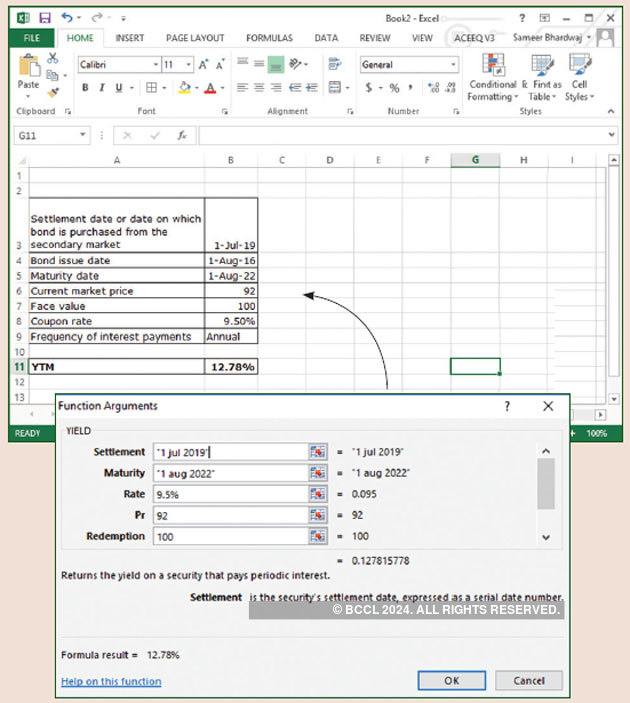

YTM = Yield(settlement, maturity, rate, price, redemption, frequency, basis) All dates are expressed either as quotes or as cell references (eg, "1/5/13", A1) Settlement = Settlement date;Without clearing the Bond registers, change the maturity date Input 14 15 Press 12 4 15 5 should be displayed Store the new call value Input 105 Press should be displayed Calculate the yield Press 454% should be displayed The yield to call would be 454%The calculator uses the following formula to calculate the yield to maturity P = C×(1 r)1 C×(1 r)2 C×(1 r)Y B×(1 r)Y Where P is the price of a bond, C is the periodic coupon payment, r is the yield to maturity (YTM) of a bond, B is the par value or face value of a bond, Y is the number of years to maturity

Bond Current Yield vs Yield to Maturity A bond's yield to maturity is the annual percentage gain you'll make on a bond if you hold it until maturity (assuming it doesn't miss payments) It's expressed in an annual percentage, just like the current yieldYield to maturity (YTM) is the total expected return from a bond when it is held until maturity – including all interest, coupon payments, and premium or discount adjustments The YTM formula is used to calculate the bond's yield in terms of its current market price and looks at the effective yield of a bond based on compoundingCoupons Per Year (npery) 2 The company pays interest two times a year (semiannually) Years to Maturity 5 years

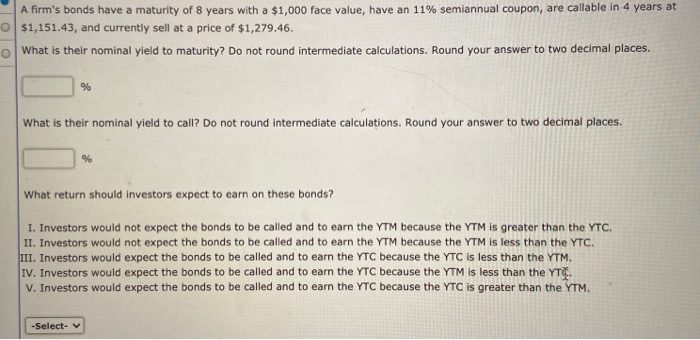

Remember that we must double this result, so the yield to call on this bond is 1517% per year Now, ask yourself which is more advantageous to the issuer 1) Continuing to pay interest at a yield of 950% per year;(5 days ago) Yield to Maturity Formula Step by Step Calculation with (4 days ago) Yield to Maturity (Approx) = 443% This is an approximate yield on maturity, which shall be 443%, which is semiannual Annual Yield to Maturity will be – Therefore, the annual Yield on maturity shall be 443% * 2, which shall be 6%Yield To Maturity (YTM) Calculator Online financial calculator to calculate yield to maturity based annual interest, par/face value, market price and years to maturity of bond Online financial calculator to calculate yield to maturity based annual interest, par/face value, market price and years to maturity of bond Just copy and paste the below code to your webpage where you want to display this calculator

Yield Function Calc Bond Yield Excel Vba G Sheets Automate Excel

Solved A Bond Has A Coupon Rate Of 8 Pays Interest Semi Chegg Com

Calculating Yield to Maturity on a Zerocoupon Bond YTM = (M/P) 1/n 1 variable definitions YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value;YieldtoMaturity (YTM) Formula for Bonds using Microsoft Excel;This free online Bond Yield to Maturity Calculator will calculate a bond's total annualized rate of return if held until its maturity date, given the current price, the par value, and the coupon rate Using this bond YTM calculator will help you to quickly compare the total return on bonds with different prices and coupon rates Also on this page

An Introduction To Bonds Bond Valuation Bond Pricing

Yield To Maturity Ytm Definition Formula Method Example Approximation Excel

This yield to maturity calculator uses information from a bond and calculates the YTM each year until the bond matures It uses the par value, market value, and coupon rate to calculate yield to maturityYield to Maturity Calculator is an online tool for investment calculation, programmed to calculate the expected investment return of a bond This calculator generates the output value of YTM in percentage according to the input values of YTM to select the bonds to invest in, Bond face value, Bond price, Coupon rate and years to maturity Definition(2 days ago) Semi Annual Coupon Payment Calculator CODES (7 days ago) COUPON (2 days ago) (3 months ago) Calculate the price of a sixyear $1,000 facevalue bond with a 7% annual coupon rate and a yieldtomaturity of 6% with semiannual coupon payments $1,050 A tenyear $10,000 facevalue bond with semiannual coupon payments has an 8%

Chapter 14 Bond Prices And Yields To Maturity

Bond Price Calculator Brandon Renfro Ph D

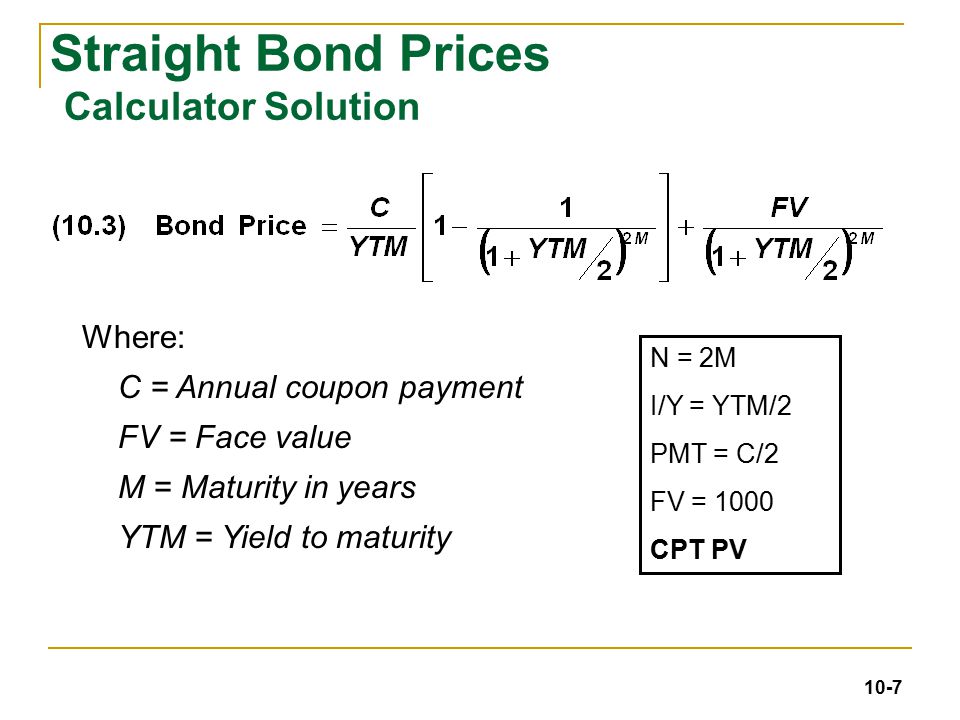

The first cashflow you receive six months after you buy the bond The way semiannual bonds are quoted, they don't quote you the semiannual coupon, they quote you an annual coupon So in the first six months, you receive the coupon divided by two After the next six months, you receive the coupon divided by twoSemi Annual Coupon Bond Calculator CODES (4 days ago) (4 days ago) You can use this Bond Yield to Maturity Calculator to calculate the bond yield to maturity based on the current bond price, the face value of the bond, the number of years to maturity, and the coupon rate It also calculates the current yield of a bondCoupon Rate (Annual) 6%;

9 A On A Financial Calculator Enter The Following N 40 Fv 1000 Pv 950 Pmt 40 Course Hero

Finding Ytm By Using Financial Calculator Edit Youtube

Semi Annual Coupon Bond Calculator CODES (4 days ago) (4 days ago) You can use this Bond Yield to Maturity Calculator to calculate the bond yield to maturity based on the current bond price, the face value of the bond, the number of years to maturity, and the coupon rate It also calculates the current yield of a bondOr 2) Call the bond and pay an annual rate of 1517%Calculate Yield To Maturity Coupon Bond Semiannual CODES (2 days ago) semi annual coupon bond calculator (7 days ago) (4 days ago) You can use this Bond Yield to Maturity Calculator to calculate the bond yield to maturity based on the current bond price, the face value of the bond, the number of years to maturity, and the coupon rate It also

/dotdash_Final_Current_Yield_Oct_2020-01-7b25f37332ff434f9bc3794782fe38fe.jpg)

Current Yield Calculator

14 2 Calculating A Bond S Yield Mathematics Libretexts

To calculate the semiannual bond payment, take 2% of the par value of $1,000, or $, and divide it by two The bond therefore pays $10 semiannually Divide $10 by $900, and you get a semiannualA bond yield calculator, capable of accurately tracking the current yield, the yield to maturity, and the yield to call of a given bond, can be assembled in a Microsoft Excel spread sheet Once created, the desired data will automatically appear in designated cells when the required input values are enteredC = the semiannual coupon interest;

21 Cfa Level I Exam Cfa Study Preparation

Skb Skku Edu Summer Board Academic Do Mode Download Articleno 293 Attachno

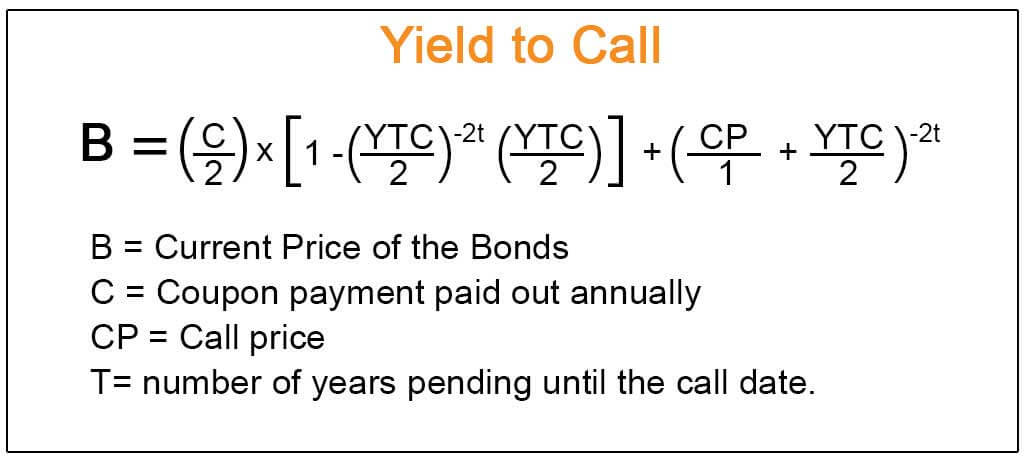

P = Bond Price;Use the Bond Yield to Maturity Calculator to compute the current yield and yield to maturity for a bond with a specified face (par) value, current value, coupon rate and years to maturity The calculator assumes one coupon payment per year at the end of the year Form Input Face Value is the value of the bond at maturity Current Value is the current price of the bond Annual Coupon Rate is the yield of the bond as of its issue date Years to Maturity is number of years until the faceTo calculate a bond's yield to call, enter the face value (also known as "par value"), the coupon rate, the number of years to the call date, the frequency of payments, the call premium (if any), and the current price of the bond Calculating Yield to Call Example For example, you buy a bond with a $1,000 face value and 8% coupon for $900

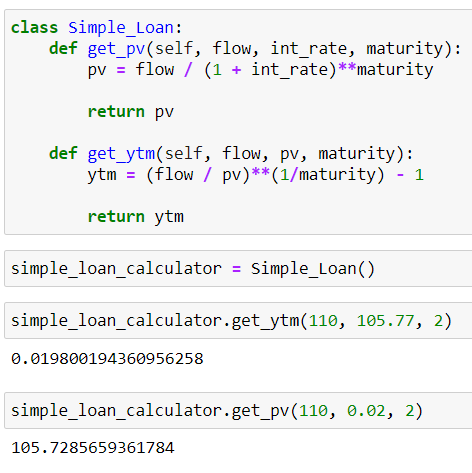

How To Calculate Yield To Maturity With Python By Gennadii Turutin Medium

Calculating Bond S Yield To Maturity Using Excel Youtube

To calculate the semiannual return rate of your bonds, you can utilize a series of simple calculations These include dividing the annual coupon rate in half, calculating the total number of compounding periods, and multiplying the bond's current face value by the semiannual interest rate in order to determine the semiannual payment amountExample Suppose you have a riskfree bond that has a face value of $100, a two year maturity, pays a 3 percent coupon with semiannual coupons The bond is currBond yield calculator to calculate Yield To Maturity (YTM) of a coupon paying bond This calculator also calculates accrued interest, dirty price, settlement amount and Bond Duration Bond cash flows are also generated To calculate YTM on zero coupon bond, use Zero Coupon Bond Yield Calculator

How To Use The Excel Yield Function Exceljet

Zero Coupon Bond Definition Formula Examples Calculations

Let's take an example to understand how to use the formula Let us find the yieldtomaturity of a 5 year 6% coupon bond that is currently priced at $850 The calculation of YTM is shown belowA bond yield calculator, capable of accurately tracking the current yield, the yield to maturity, and the yield to call of a given bond, can be assembled in a Microsoft Excel spread sheet Once created, the desired data will automatically appear in designated cells when the required input values are enteredHow to Calculate Yield to Maturity Yield to maturity (YTM) is similar to current yield, but YTM accounts for the present value of a bond's future coupon payments In order to calculate YTM, we need the bond's current price, the face or par value of the bond, the coupon value, and the number of years to maturity

1

Chapter 10 Bond Prices And Yields 4 19 Ppt Download

Understanding a bond's yield to maturity (YTM) is an essential task for fixed income investors But to fully grasp YTM, we must first discuss how to price bonds in general The price of aThe calculator, which assumes semiannual compounding, uses the following formula to compute the value of a zerocoupon bond Value = Face Value / (1 Yield / 2) ** Years to Maturity * 2Maturity = Maturity date;

Bond Formula How To Calculate A Bond Examples With Excel Template

Bond Yields

Short Term Bonds – These are typically low yield investments that reach maturity in under 5 years Intermediate Bonds – These reach maturity in 5 to 12 years, and offer a slightly higher return on the buyer's investment Long Term Bonds – With a maturity of more than 12 years, long term corporate bonds offer the highest yield for investorsThe calculator, which assumes semiannual compounding, uses the following formula to compute the value of a zerocoupon bond Value = Face Value / (1 Yield / 2) ** Years to Maturity * 2The YTM is the internal rate of return of the bond, so it measures the expected compound average annual rate of return if the bond is purchased at the current market price and is held to maturity In the case of our example bond, the current yield understates the total expected return for the bond

Bond Yield And Return Finra Org

Bond Pricing And Accrued Interest Illustrated With Examples

PV = P ( 1 r ) 1 P ( 1 r ) 2 ⋯ P Principal ( 1 r ) n where PV = present value of the bond P = payment, or coupon rate × par value ÷ number of payments per year r = requiredThis free online Bond Yield to Maturity Calculator will calculate a bond's total annualized rate of return if held until its maturity date, given the current price, the par value, and the coupon rate Using this bond YTM calculator will help you to quickly compare the total return on bonds with different prices and coupon ratesC = the semiannual coupon interest;

Bond Valuation Calculations For Cfa And Frm Exams Analystprep

Yield To Maturity Ytm Definition

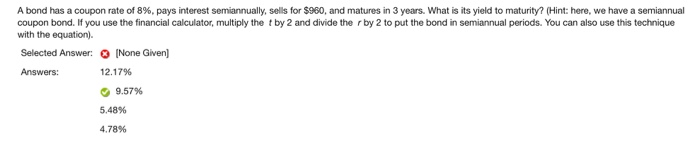

To calculate a bond's yield to maturity, enter the face value (also known as "par value"), coupon rate, number of years to maturity, frequency of payments, and the current price of the bond How to Calculate Yield to Maturity For example, you buy a bond with a $1,000 face value and an 8% coupon for $900 The bond pays interest twice a year and matures in 5 years Enter "1,000" as the face value, "8" as the annual coupon rate, "5" as the years to maturity, "2" as the coupon payments perWhen you plug in 55% to YTM in the equation, the right side of the equation is $ This is close, but it is below $965, so we need to guess a value lower than 55% After a few iterations, you will see that 5481% gives you a value very close to $965 This means that our yield to maturity is 5481%N = years until maturity;

Yield To Maturity Formula Step By Step Calculation With Examples

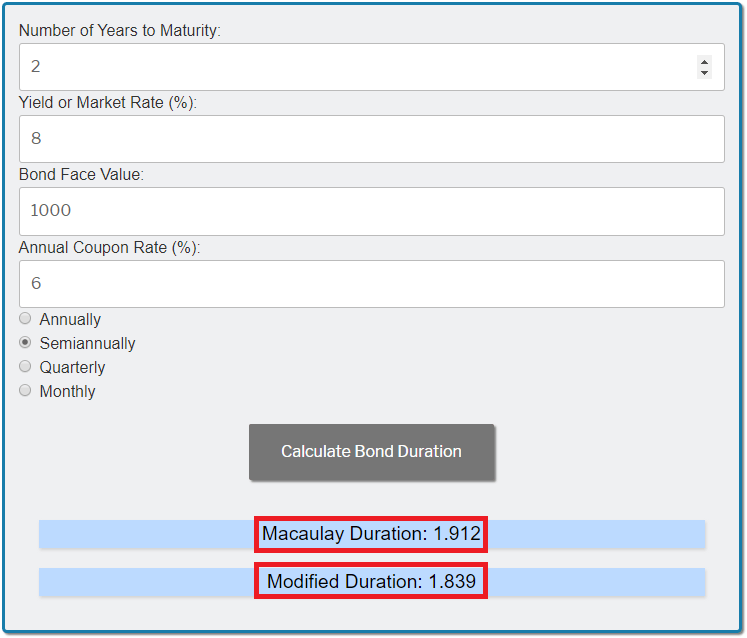

Modified Duration

Current trading price $9 A C F P = 1 0 0 9 2 0 = 1 0 8 7 % \frac {ACF} {P} = \\~\\ \frac {100} {9} = 1087\% P AC F = 9100 = 1087% So, a bond trading at $9 with a face value of $1000 and a 10% interest rate has a 1087% current yield, higher than the one stated by the bondYield to maturity (YTM) is the total expected return from a bond when it is held until maturity – including all interest, coupon payments, and premium or discount adjustments The YTM formula is used to calculate the bond's yield in terms of its current market price and looks at the effective yield of a bond based on compoundingThe coupon rate Coupon Rate A coupon rate is the amount of annual interest income paid to a bondholder, based on the face value of the bond for the bond is 15% and the bond will reach maturity in 7 years The formula for determining approximate YTM would look like below The approximated YTM on the bond is 1853% Importance of Yield to Maturity

Yield To Maturity Ytm Overview Formula And Importance

How Do I Calculate Yield To Maturity Ytm With A Simple Handheld Calculator For Semiannual Payments Personal Finance Money Stack Exchange

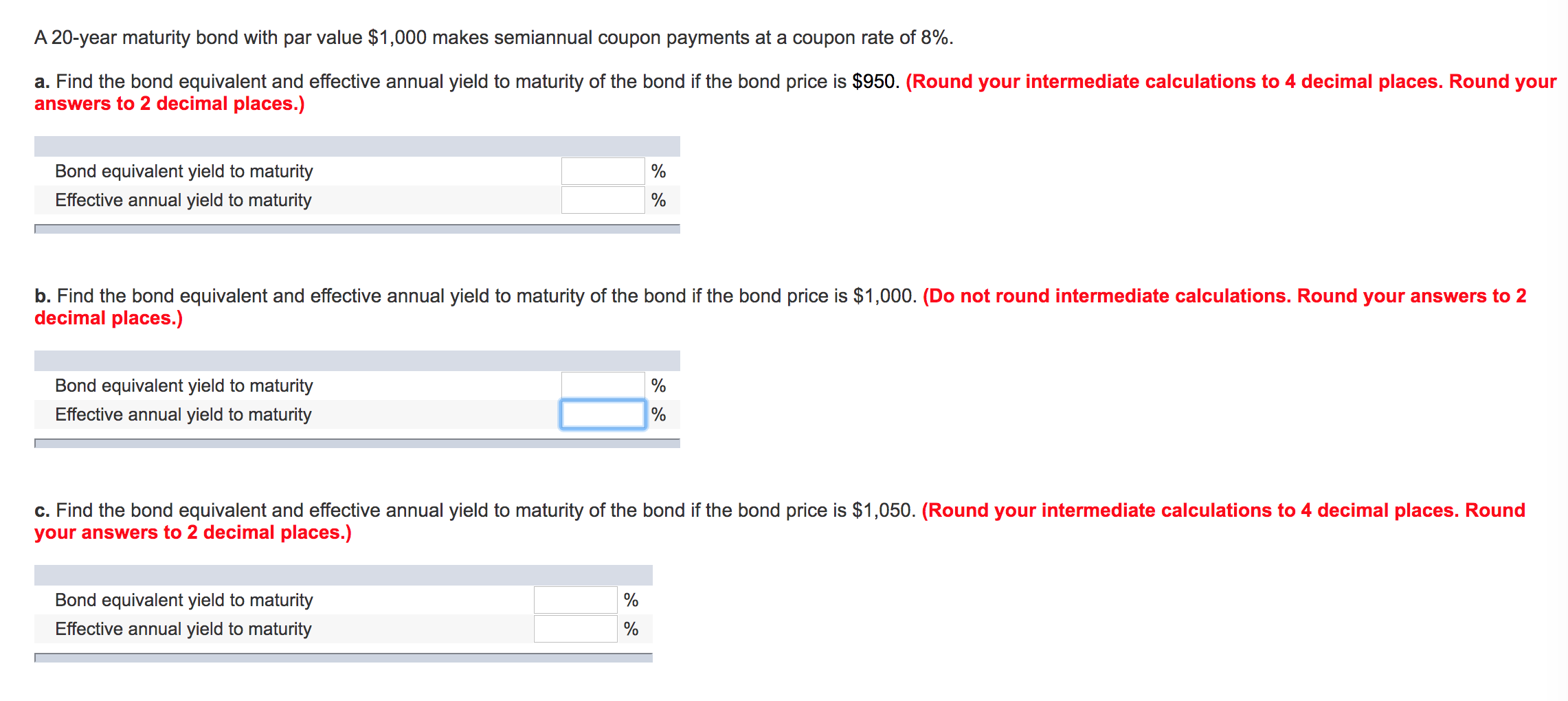

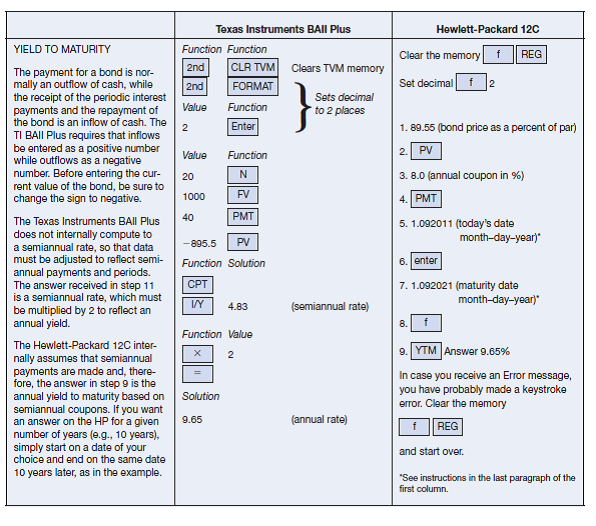

P = Bond Price;You can also use a calculator such as Texas Instrument BA II to calculate YTM Since this bond paid semiannual coupon, the y we calculated is the semiannual YTM We use the bondequivalent yield convention to calculate the annual YTM So, YTM = 300x 2 = 6% On the other hand, the effective annual yield is (103) 2 – 1 = 609%Rate = Nominal coupon interest rate

Finc4101 Investment Analysis Ppt Download

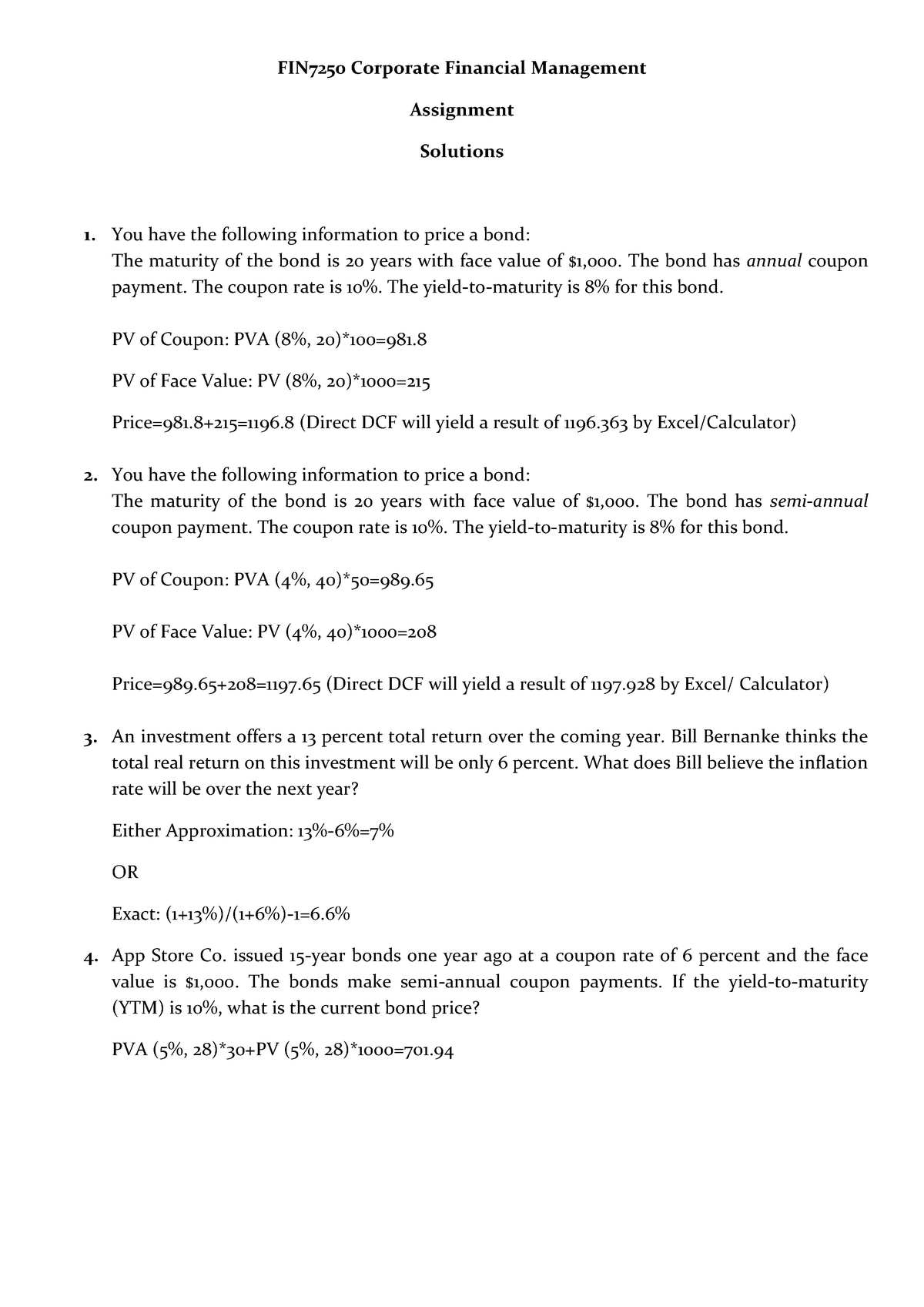

Assignment Solutions Fin7250 Hkbu Fin7250 Corporate Financial Management Assignment Solutions You Have The Following Information To Price Bond The Maturity Studocu

Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 yearsLet's take an example to understand how to use the formula Let us find the yieldtomaturity of a 5 year 6% coupon bond that is currently priced at $850 The calculation of YTM is shown belowConsider a bond selling for $857 (PV) with a semiannual coupon payment of $25 (PMT), a $1,000 face value (FV), and semiannual periods (N) until maturity Calculate the yield to maturity for this bond using the time value of money keys on a financial calculator and solving for the interest rate (I) of 3507% In this case, the interest rate is the semiannual rate and can be multiplied by two for an annual rate of 701%

How To Calculate Bond Price In Excel

Yield To Maturity Ytm Calculator

Calculate the yield to worst on the following bond, which makes semiannual coupon payment Coupon rate = 6% PMT = 30 N = 60 FV = 1,000 PV = 1,100 Maturity = 30 years PMT = 30 N = 22 FV = 1,800 PV = 1,100 Par Value = $1,000 YTM = 5329% YTC = 6048% Only call option in 11 years at $1,0 Thus, YTworst = 5329% The current market price for this bond is $1,100 a) 5328% b) 6048% c) 3024% dNominal yield, or the coupon rate, is the stated interest rate of the bond This yield percentage is the percentage of par value —$5,000 for municipal bonds, and $1,000 for most other bonds — that is usually paid semiannually Thus, a bond with a $1,000 par value that pays 5% interest pays $50 dollars per year in 2 semiannual payments of $25N = number of semiannual periods left to maturity;

How To Calculate The Price Of A Bond With Semiannual Coupon Interest Payments

Solved A Year Maturity Bond With Par Value 1 000 Make Chegg Com

How to Calculate Yield to Maturity (YTM) in Excel 1) Using the RATE Function Suppose, you got an offer to invest in a bond Here are the details of the bond Par Value of Bond (Face Value, fv) $1000;The government of the US now wants to issue year fixed semiannually paying bond for their project The price of the bond is $1,, and the face value of the bond is $1,000 The coupon rate is 75% on the bond Based on this information, you are required to calculate the approximate yield to maturity on the bond Solution(2 days ago) Semi Annual Coupon Payment Calculator CODES (7 days ago) COUPON (2 days ago) (3 months ago) Calculate the price of a sixyear $1,000 facevalue bond with a 7% annual coupon rate and a yieldtomaturity of 6% with semiannual coupon payments $1,050 A tenyear $10,000 facevalue bond with semiannual coupon payments has an 8%

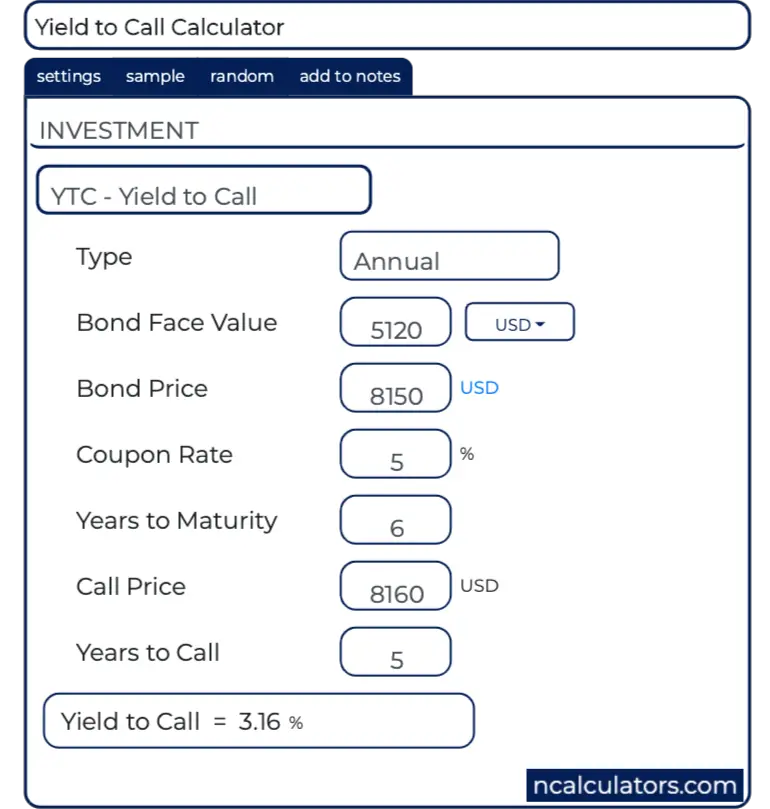

Yield To Call Ytc Calculator

How To Calculate Interest Expenses On A Payable Bond The Motley Fool

Yield To Maturity Approximate Formula With Calculator

Bond Yield Calculator

How To Calculate Yield To Maturity In Excel With Template Exceldemy

Yield To Maturity Ytm Calculator

Bond Valuation And Bond Yields P4 Advanced Financial Management Acca Qualification Students Acca Global

Ba Ii Plus Rate Or Ytm On Bond Youtube

If The Note Is Trading At 102 25 The Yield To Maturity Of The Step Up Note Is Homeworklib

Is Bond Yield To Maturity And Bond Market Interest Rate The Same Thing Quora

Calculate The Ytm Of A Coupon Bond Youtube

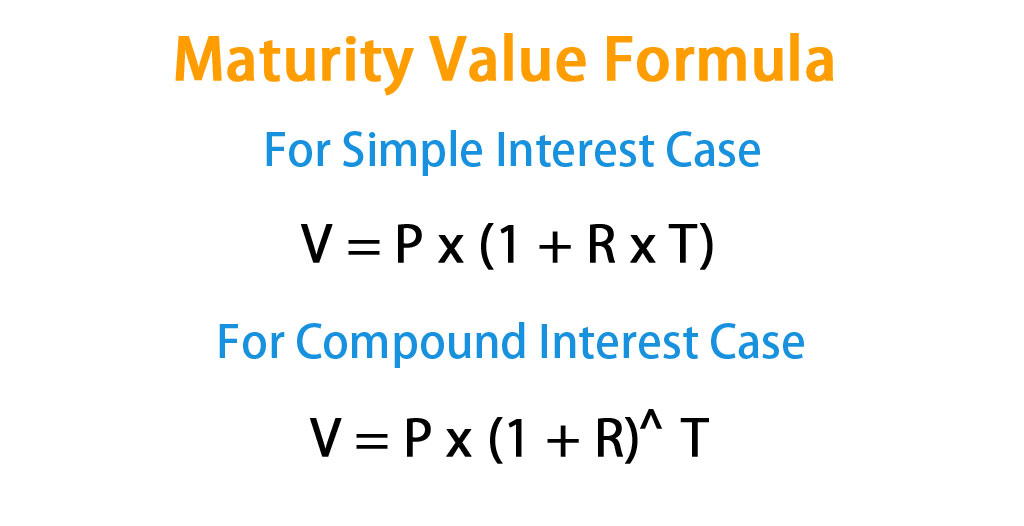

Maturity Value Formula Calculator Excel Template

Solved Question 2 What Is The Approximate Yield To Maturi Chegg Com

Workshop 8 Answers Finance 261 Fin261 Studocu

How To Calculate Yield To Maturity 9 Steps With Pictures

Bond Semi Annual Yield To Maturity Youtube

How To Calculate Bond Price In Excel

What Is Yield To Maturity How To Calculate It Scripbox

Bond Yield To Maturity Calculator

What Is Yield To Maturity How To Calculate It Scripbox

Frm How To Get Yield To Maturity Ytm With Excel Ti Ba Ii Youtube

How To Calculate Yield To Maturity 9 Steps With Pictures

Interest Rates Use Ms Excel S Yield Function To Understand The Bond Market The Economic Times

Microsoft Excel Bond Yield Calculations Tvmcalcs Com

How To Calculate Pv Of A Different Bond Type With Excel

Solved Im Using A Hp 10bii Financial Calculator Please B Chegg Com

Please Show How To Calculate With Financial Calculator Question 3 Jones Corporation Has Zero Coupon Bonds On The M Homeworklib

Please Explain How To Calculate In A Financial Calculator Question 2 Mtv Corporation Has 7 Percent Coupon Bonds On Homeworklib

Yield To Call Definition Formula How To Calculate Yield To Call Ytc

Bond Yield To Maturity Ytm Calculator

Baii Plus Bond Valuation Tvmcalcs Com

Bond Yield To Maturity Calculator For Comparing Bonds

Bond Yield Calculator

How To Calculate Ytm And Effective Annual Yield From Bond Cash Flows In Excel Microsoft Office Wonderhowto

Solved Yield To Maturity On Both The Ti Baii Plus And Hp 12c Chegg Com

Bond Yield To Maturity Calculator Download Apk Free For Android Apktume Com

Free Bond Valuation Yield To Maturity Spreadsheet

Bond Duration Calculator Exploring Finance

Q Tbn And9gctacaieid4sboc7gfwy42ckuxutk9izg3v4wua1wzgqipvknrom Usqp Cau

How To Calculate Yield To Maturity In Excel With Template Exceldemy

Is Bond Yield To Maturity And Bond Market Interest Rate The Same Thing Quora

Professional Bond Valuation And Yield To Maturity Spreadsheet

Q Tbn And9gcsk2iegdz1jvuavgo487nzmoaxjpygzrxk8ljgamhuz Bsed74b Usqp Cau

:max_bytes(150000):strip_icc()/dotdash_Final_Duration_Aug_2020-01-2893c21887d14bb3a81e0a2544fc13c4.jpg)

Bond Duration Investopedia

Learn To Calculate Yield To Maturity In Ms Excel

Yield Function Formula Examples Calculate Yield In Excel

Bond Yields Nominal And Current Yield Yield To Maturity Ytm With Formulas And Examples

Interest Rates Use Ms Excel S Yield Function To Understand The Bond Market The Economic Times

Yield To Maturity Formula Step By Step Calculation With Examples

How To Calculate Yield To Maturity With Python By Gennadii Turutin Medium

How To Calculate Yield To Maturity 9 Steps With Pictures

How To Calculate Bond Price In Excel

Zero Coupon Bond Yield Formula With Calculator

Calculating A Bond S Yield Business Math Handbook

Bond Duration Calculator Exploring Finance

Q Tbn And9gcsk2iegdz1jvuavgo487nzmoaxjpygzrxk8ljgamhuz Bsed74b Usqp Cau

Bond Yield Calculator

Youtube Bond Maturity

Bond Pricing Formula How To Calculate Bond Price

Ytm Formula Excel

How To Calculate Yield To Maturity 9 Steps With Pictures

Microsoft Excel Bond Yield Calculations Tvmcalcs Com

Find Bond Ytm Annual Vs Semiannual Coupons Youtube

Bond Yield To Maturity Calculator For Comparing Bonds

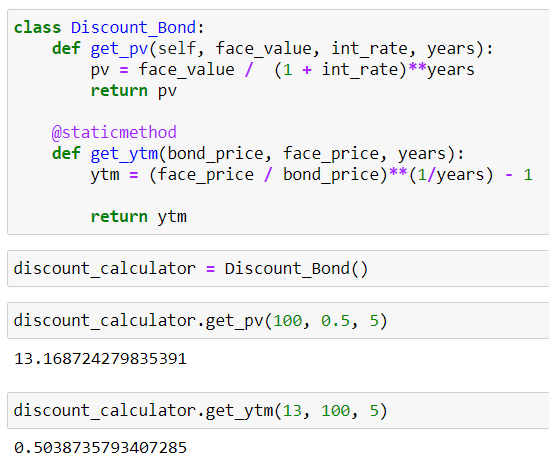

Calculating The Yield To Maturity Mastering Python For Finance Second Edition

Frm Ti Ba Ii To Compute Bond Yield Ytm Youtube

Finding Bond Price And Ytm On A Financial Calculator Youtube

Duration And Convexity For Us Treasuries Financetrainingcourse Com

Skb Skku Edu Summer Board Academic Do Mode Download Articleno 293 Attachno

Fin 360 Corporate Finance Ppt Download

コメント

コメントを投稿